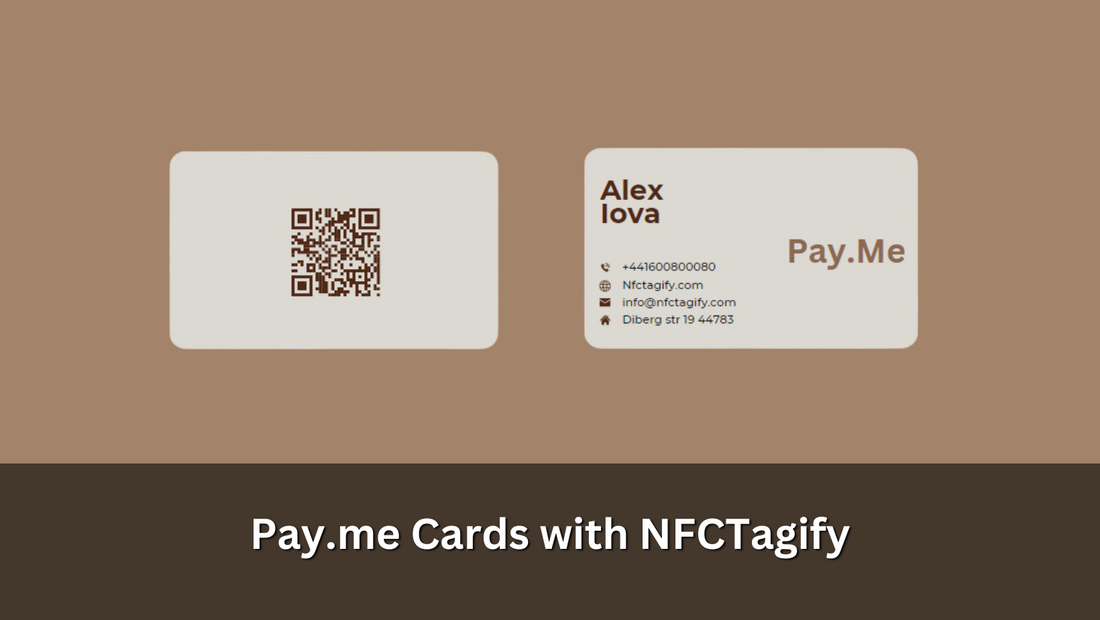

Pay.me Cards with NFCTagify

Revolutionising Payments for Modern Businesses

As digital and neo banks continue to evolve, they are offering innovative solutions for receiving payments that cater to the fast-paced, cashless world. One of the most exciting developments is the rise of Personalised payment links and QR code solutions, making it easier than ever for businesses, freelancers, and individuals to request and receive payments.

This is where NFC Tagify comes in, offering NFC-enabled smart cards that seamlessly integrate with these payment technologies. With a custom-designed NFC card, you can include your bank's payment link, such as Pay.me, and even print a QR code on the card, allowing your clients to pay you with just a tap or scan. Let’s explore how this technology works and the benefits it offers.

1. How Payment Links and QR Codes Work

In today’s world, many neo and digital banks offer services like Personalised payment links or QR codes that allow customers to make payments quickly and securely. These services are ideal for freelancers, consultants, and small businesses who need to receive payments on the go. Banks such as PayPal, Revolut, Bunq, Monzo, and Starling provide these options, making it easy for users to generate a link or QR code that directs payers to a secure payment portal. With just a tap or scan, transactions can be completed in seconds, eliminating the need for lengthy bank details or manual entry of payment information.

For example, with Revolut’s Personalised payment link, users can send a custom URL to anyone, allowing them to easily make payments from their account. Similarly, Monzo.me lets users share a payment link with their contacts, enabling hassle-free money transfers.

2. NFC Tagify’s Role in Streamlining Payments

NFC Tagify enhances this process by offering customised NFC cards that can store and share payment information digitally. These cards can be programmed with direct payment links, such as Pay.me, which many banks use to facilitate fast and secure transactions. By encoding the NFC card with your payment link, you allow clients or customers to tap the card with their smartphones and instantly be directed to your payment portal. No need for cash, bank details, or even card readers—just a quick tap, and the transaction is ready to go.

Additionally, NFC Tagify offers custom printing options, where you can design your NFC card with your bank’s logo or any branding of your choice. The card can also be printed with the associated QR code, giving users the option to either tap or scan to pay. This dual functionality is ideal for individuals or businesses who want to provide multiple payment methods in a single, sleek card.

You can explore NFC Tagify's customisable digital cards here:

Customised NFC Cards.

3. Top 20 Neo and Digital Banks Offering Payment Links and QR Codes

Here’s a list of top neo and digital banks offering Personalised payment links or QR code solutions, making transactions smoother and faster:

- Revolut – Personalised payment links and QR codes for easy transfers.

- Bunq – Generate payment links for secure, quick payments.

- N26 – Offers QR code payments for effortless transactions.

- Monzo – Provides payment links through Monzo.me.

- Starling Bank – Supports Starling.me links and QR codes.

- Wise (formerly TransferWise) – Enables payment links for global transfers.

- Chime – Direct payment requests, no Personalised links.

- Cash App – Personalised $Cashtag links and QR codes.

- Venmo – Share Personalised payment links or QR codes.

- Zelle – Easy transfers via email or phone number.

- Up (Australia) – QR code-based payments.

- Moven – Quick payment requests, no Personalised links.

- Qonto – QR codes for B2B payments.

- Skrill – Share payment links or QR codes.

- Payoneer – Popular for freelancers and international businesses.

- Current – QR code payments for instant transactions.

- Oxygen – In-app payment requests.

- Vivid Money – Supports both payment links and QR codes.

- TymeBank (South Africa) – QR codes for payments.

- Curve – Simplifies payment requests via the app.

4. Traditional Banks Offering Similar Solutions

Even traditional banks are adapting to this trend by integrating QR codes or enabling quick transfers via apps. Some notable examples include:

- Chase (US) – Offers Zelle integration for quick transfers.

- HSBC (UK) – Supports QR code payments.

- Barclays (UK) – QR codes for businesses.

- BBVA (Spain) – QR codes for easy payments.

- ICICI Bank (India) – QR codes via UPI for fast transactions.

These banks are bridging the gap between traditional banking and modern payment technology, making it easier for users to get paid efficiently.

5. Why Choose NFC Tagify for Pay.me Cards?

By choosing NFC Tagify for your Pay.me card, you can enjoy the benefits of custom design, seamless payments, and dual NFC-QR code functionality. Whether you're a freelancer needing quick payments or a business looking for a sleek, tech-forward way to receive funds, NFC Tagify's customisable NFC cards can revolutionise the way you handle transactions.

Upgrade your payment game with a Pay.me card from NFC Tagify, and let your clients pay you instantly with just a tap or a scan. You can also enjoy different shapes and sizes for your Pay.me card by checking: Customized PVC Cards.

We at NFC Tagify provide all sorts of NFC solutions. Contact us: Tel. 01600800080, Email: info@nfctagify.com.